Overview: For personal finance beginners who want to track spending and save money without feeling overwhelmed, Simplicit is a finance app that automatically links to your bank account and provides daily “receipt” (snapshot) of your spending with its categories, allows users to set monthly goals, and rewards them.

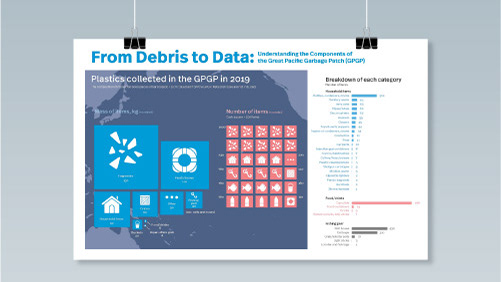

UX Research | What are digital “financial planning” products and services?

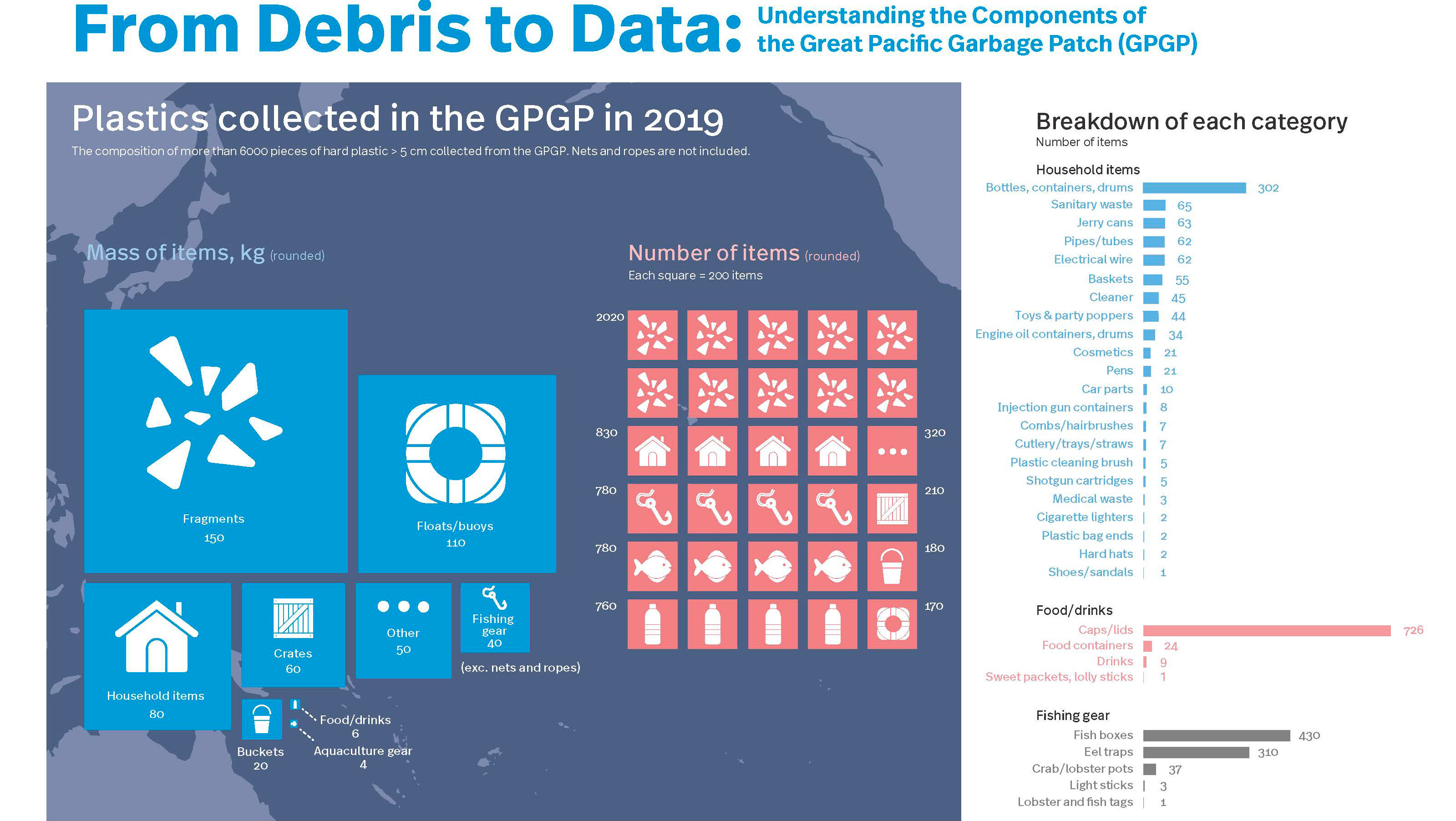

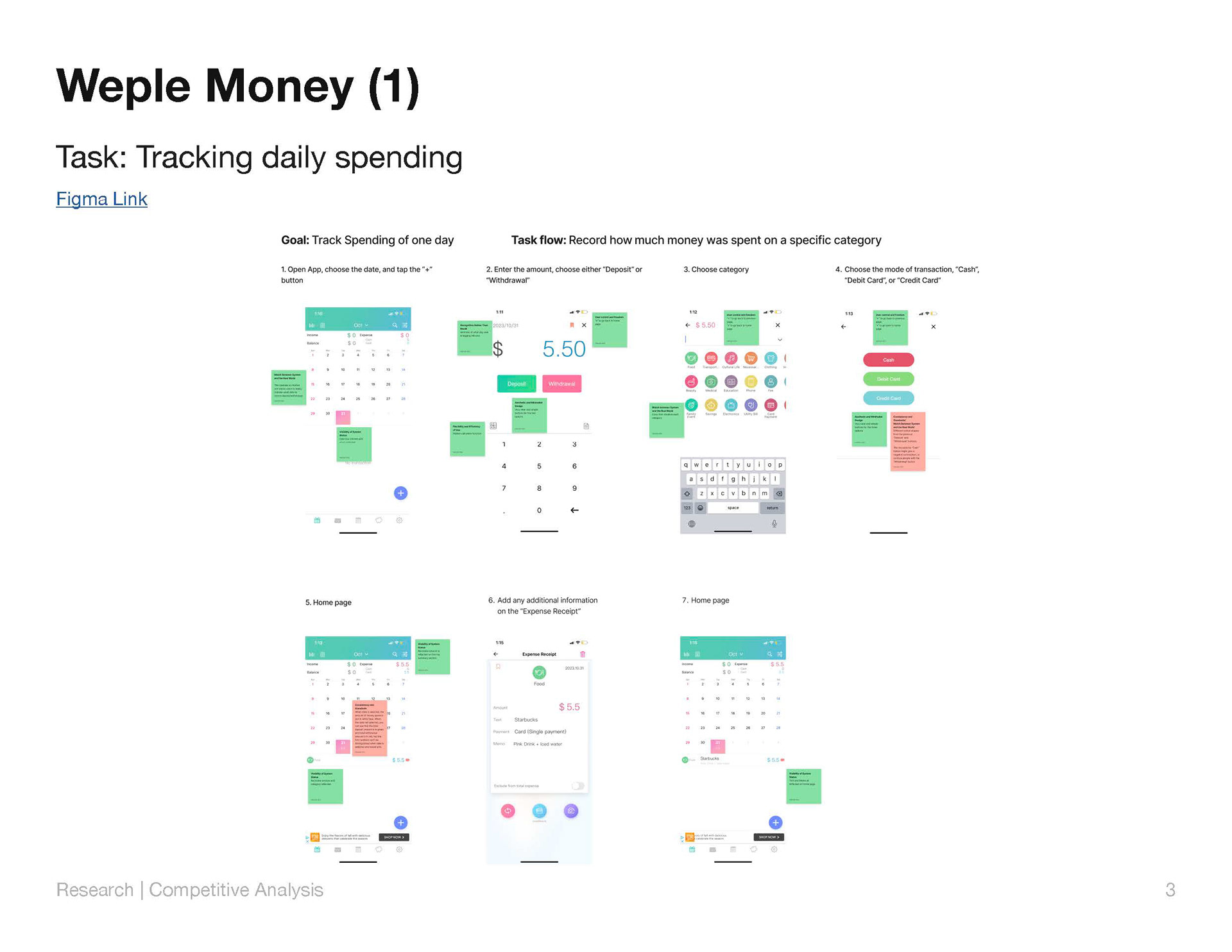

Competitive Analysis

Main Takeaways:

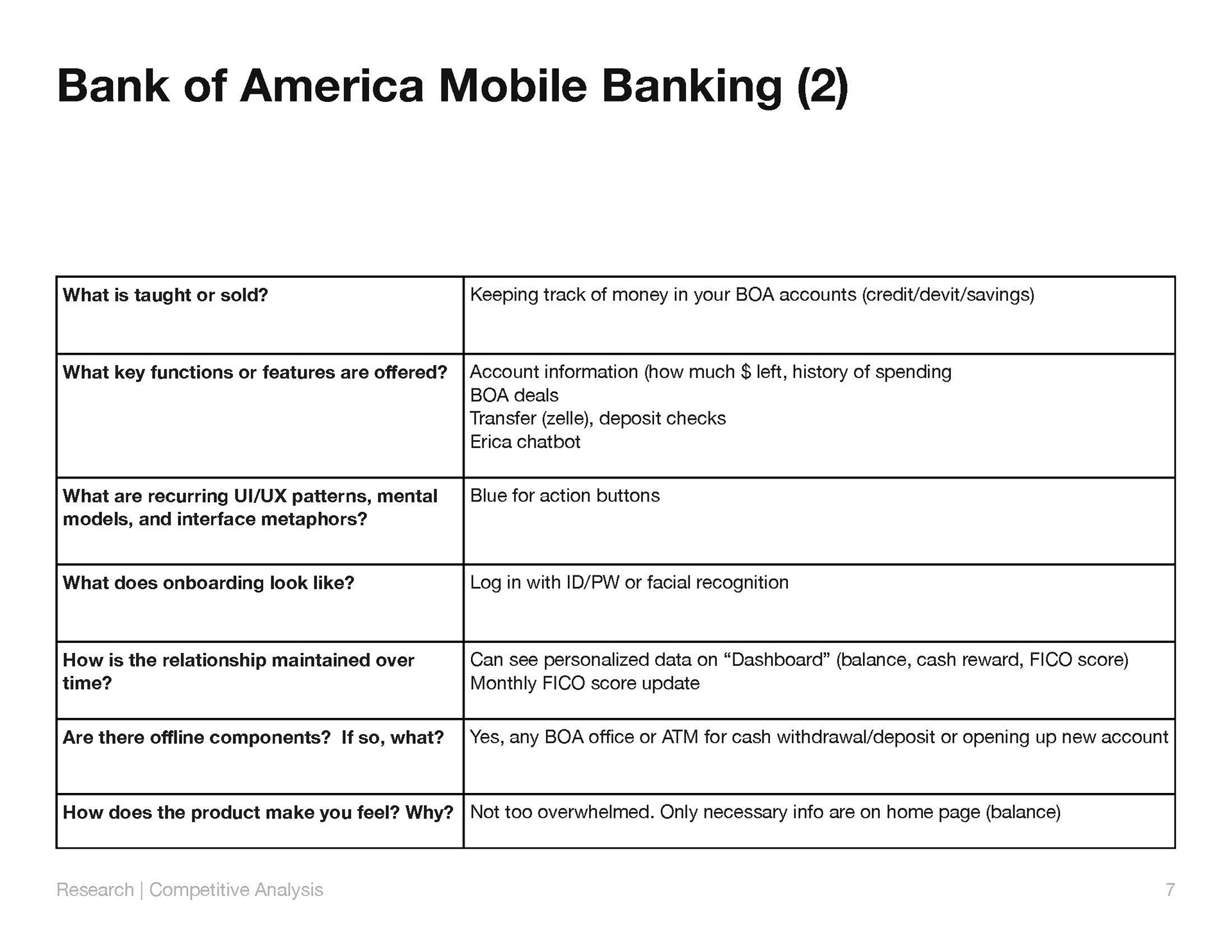

The minimalistic and colorful design engages users, turning what could be dry financial planning into a fun experience.

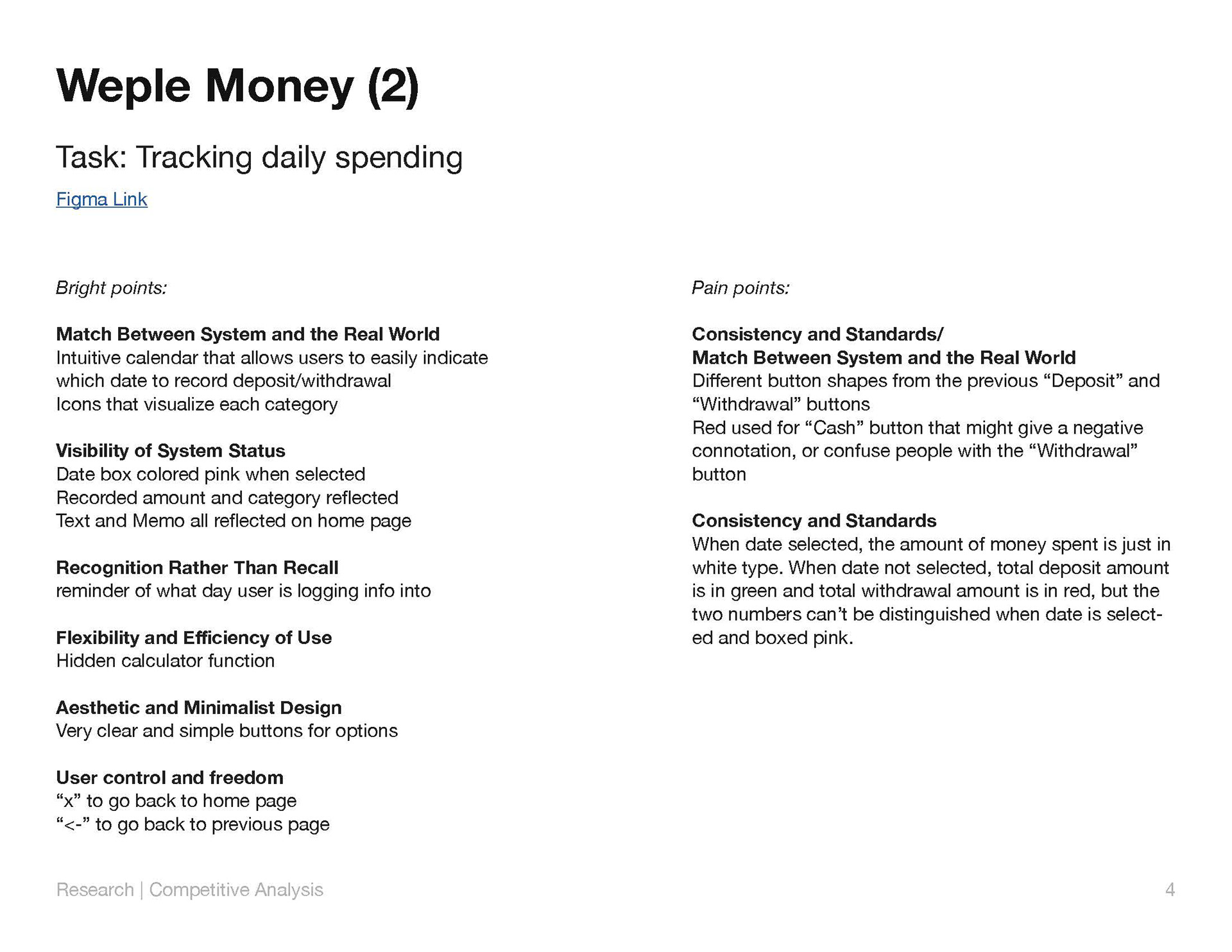

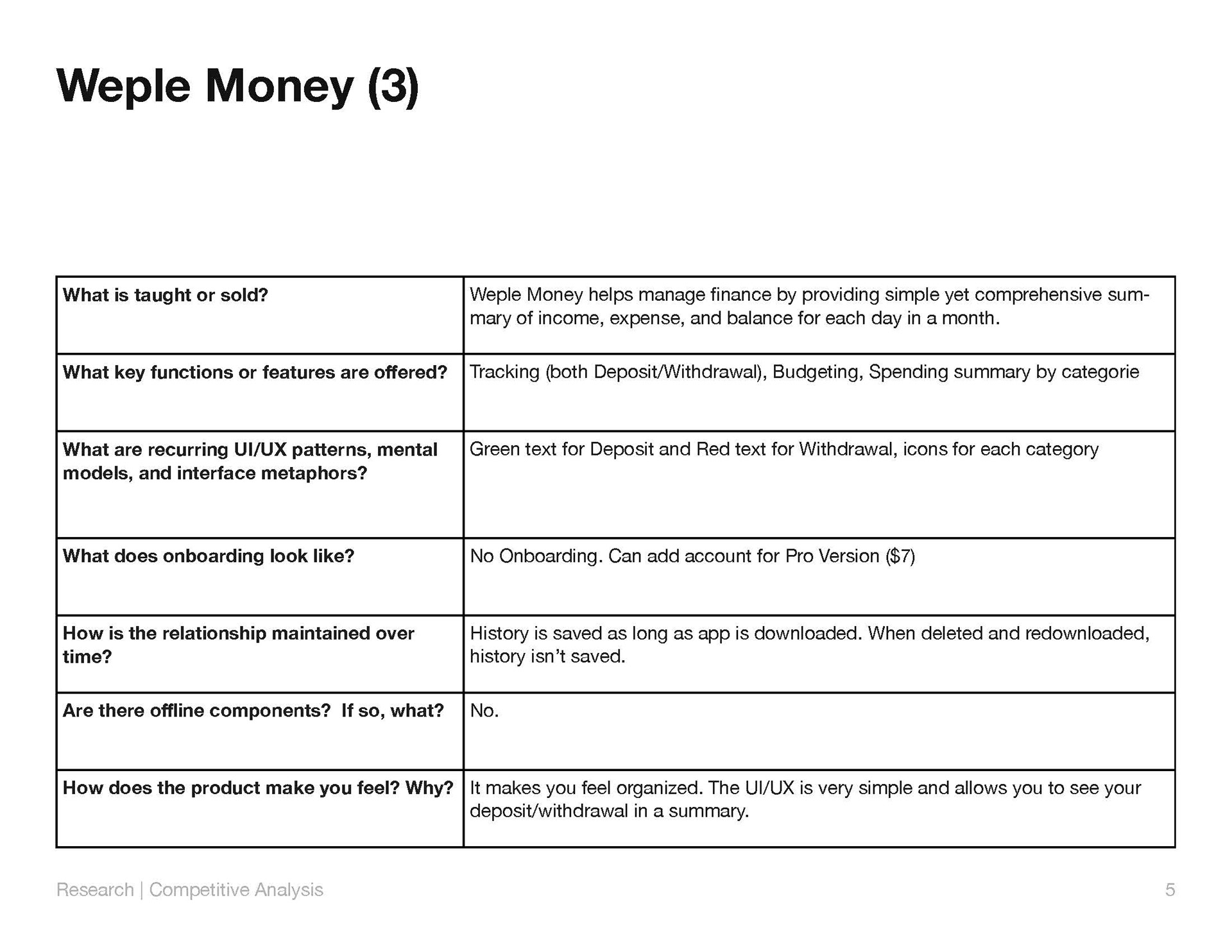

Main Takeaways:

The minimalistic and colorful design engages users, turning what could be dry financial planning into a fun experience.

Each app page asks the user to do 1-2 things, making the overall experience not overwhelming.

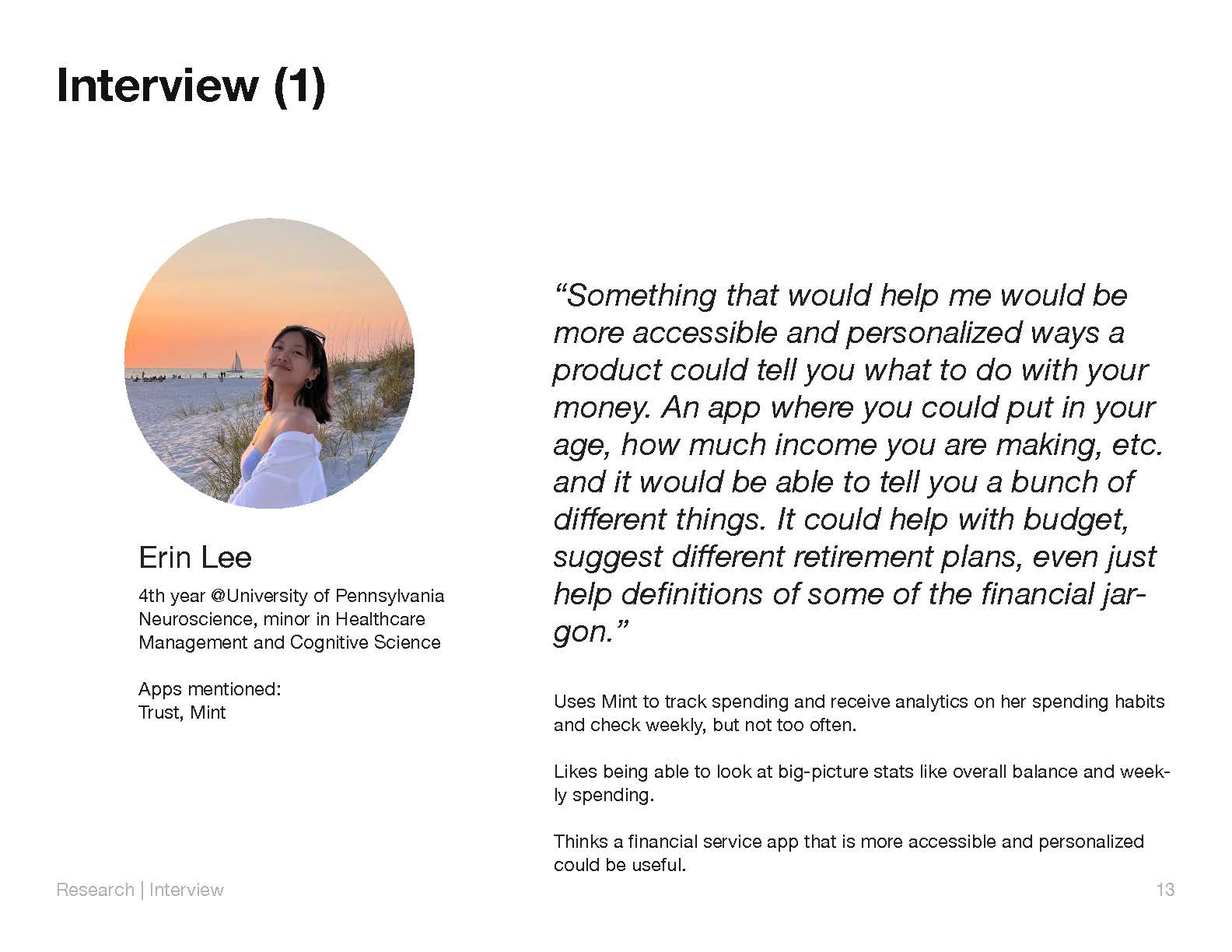

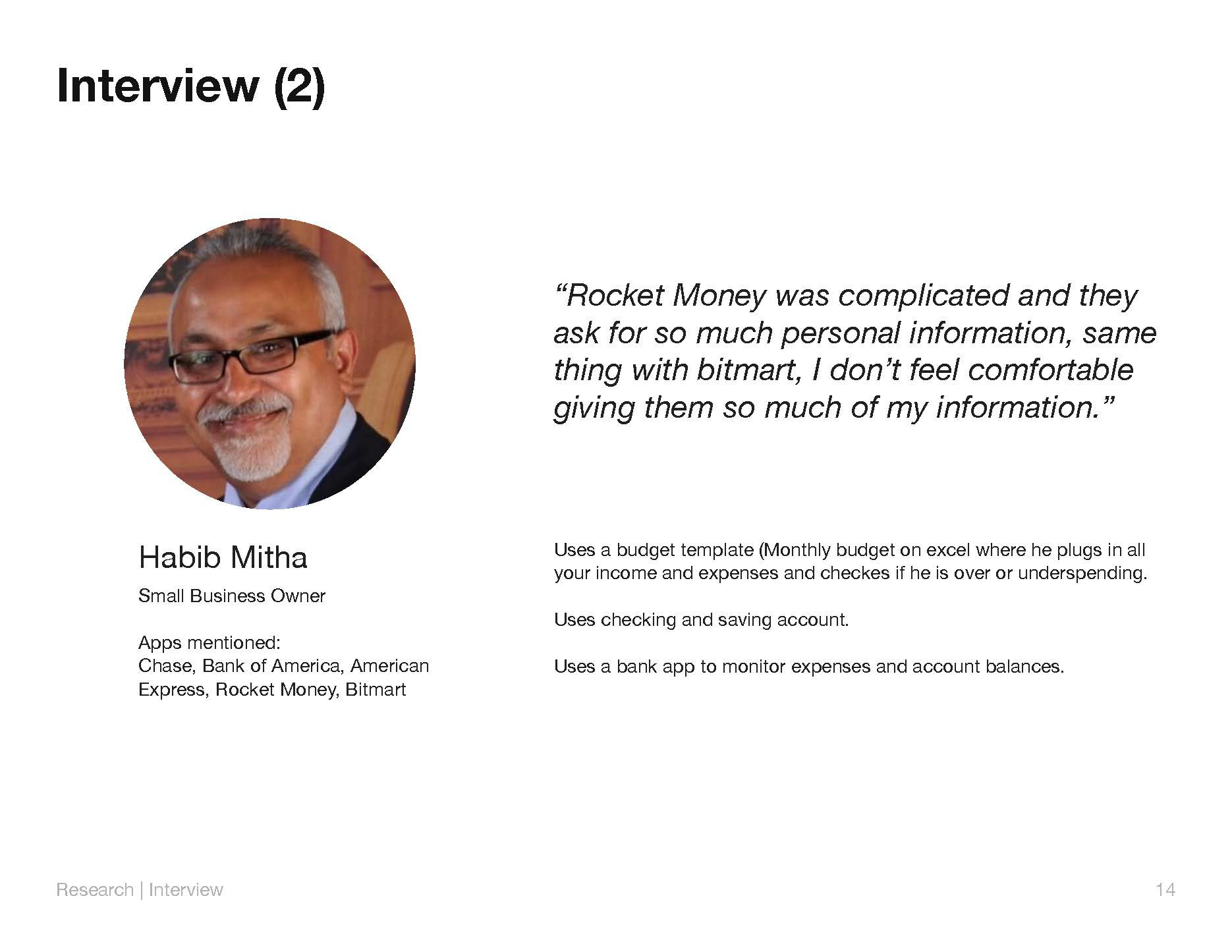

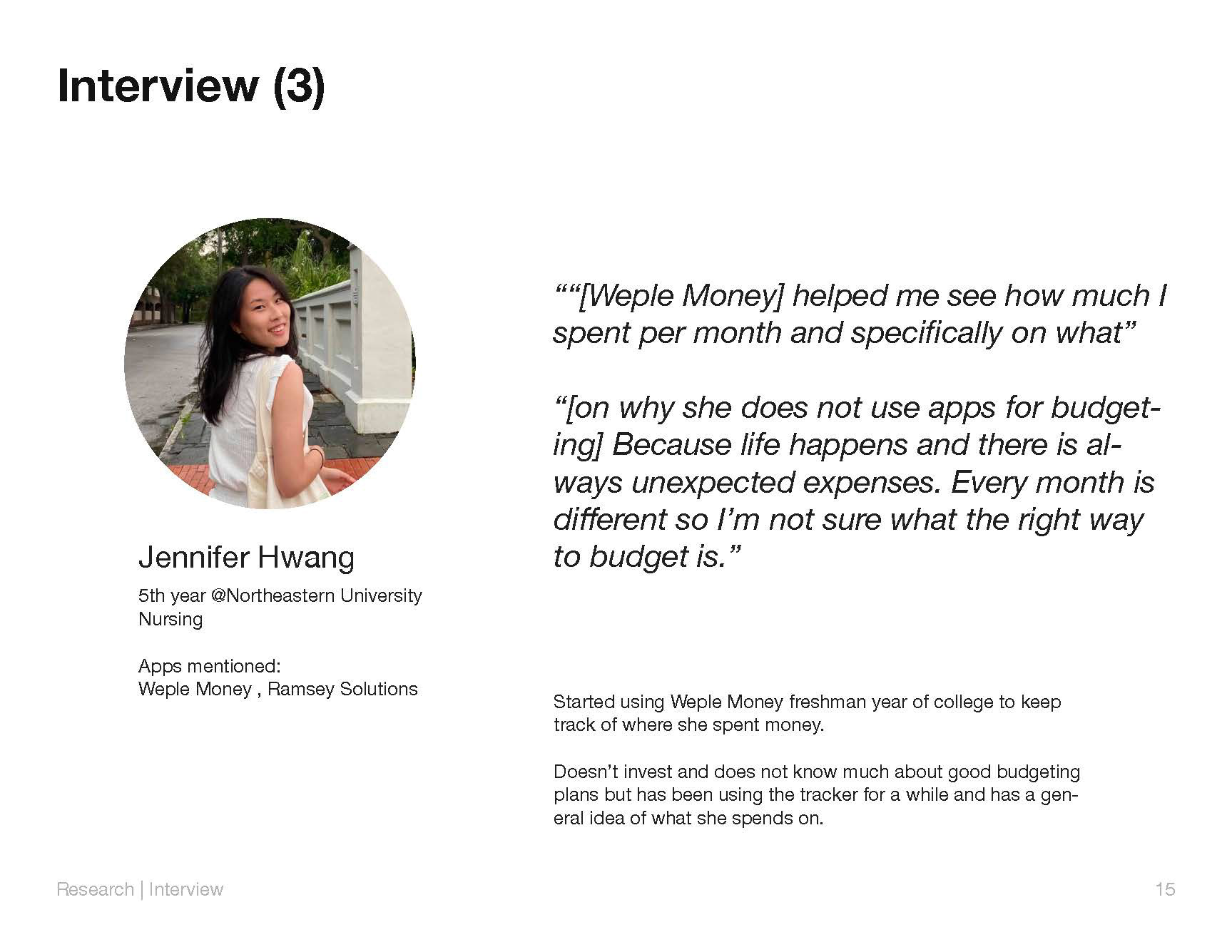

Interviews

Main Takeaways:

What unmet needs do college students exhibit?

College students often lack an understanding of long-term financial planning. They can manage week to week but are unable to manage long-term goals. They also need help understanding financial jargon.

Main Takeaways:

What unmet needs do college students exhibit?

College students often lack an understanding of long-term financial planning. They can manage week to week but are unable to manage long-term goals. They also need help understanding financial jargon.

What information or content could you provide?

Resources that explain financial planning options, and ways to make informed decisions

Definitions (financial literacy)

Financial concepts - Retirement accounts, Compounding, Investing strategies. Mortgages, car payments, Taxes, etc.

Resources that explain financial planning options, and ways to make informed decisions

Definitions (financial literacy)

Financial concepts - Retirement accounts, Compounding, Investing strategies. Mortgages, car payments, Taxes, etc.

What features could you provide?

Personalized advice, evaluation of how the user is managing their money, budgeting, cash flow tracking, goal Milestones, help with financial independence

Personalized advice, evaluation of how the user is managing their money, budgeting, cash flow tracking, goal Milestones, help with financial independence

Interpret | What are student “financial planning” needs?

HMW (How Might We) Statement

How might we help college students intentionally and effectively track, budget, and plan their finances without overwhelming them with financial jargon?

How might we help college students intentionally and effectively track, budget, and plan their finances without overwhelming them with financial jargon?

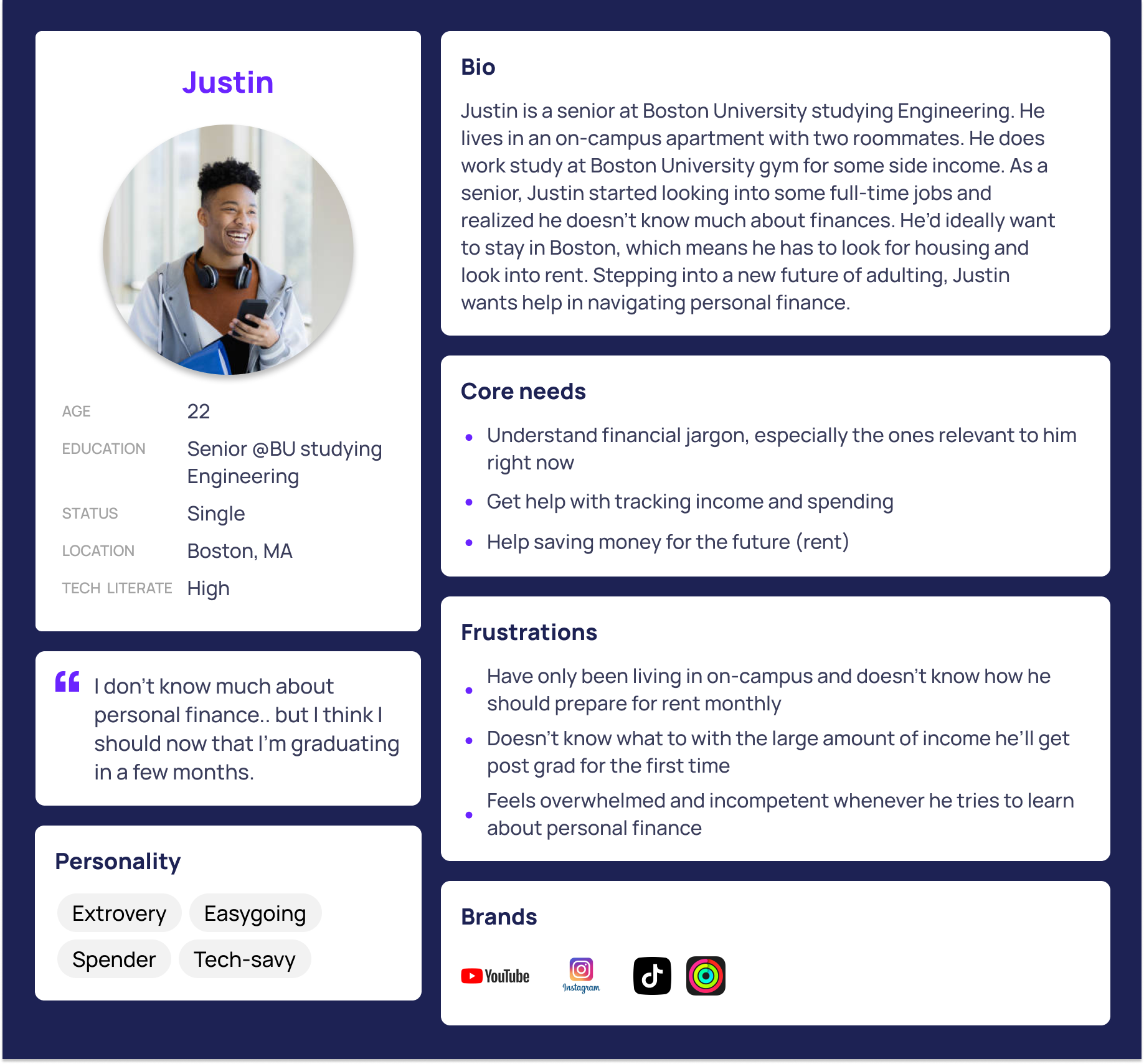

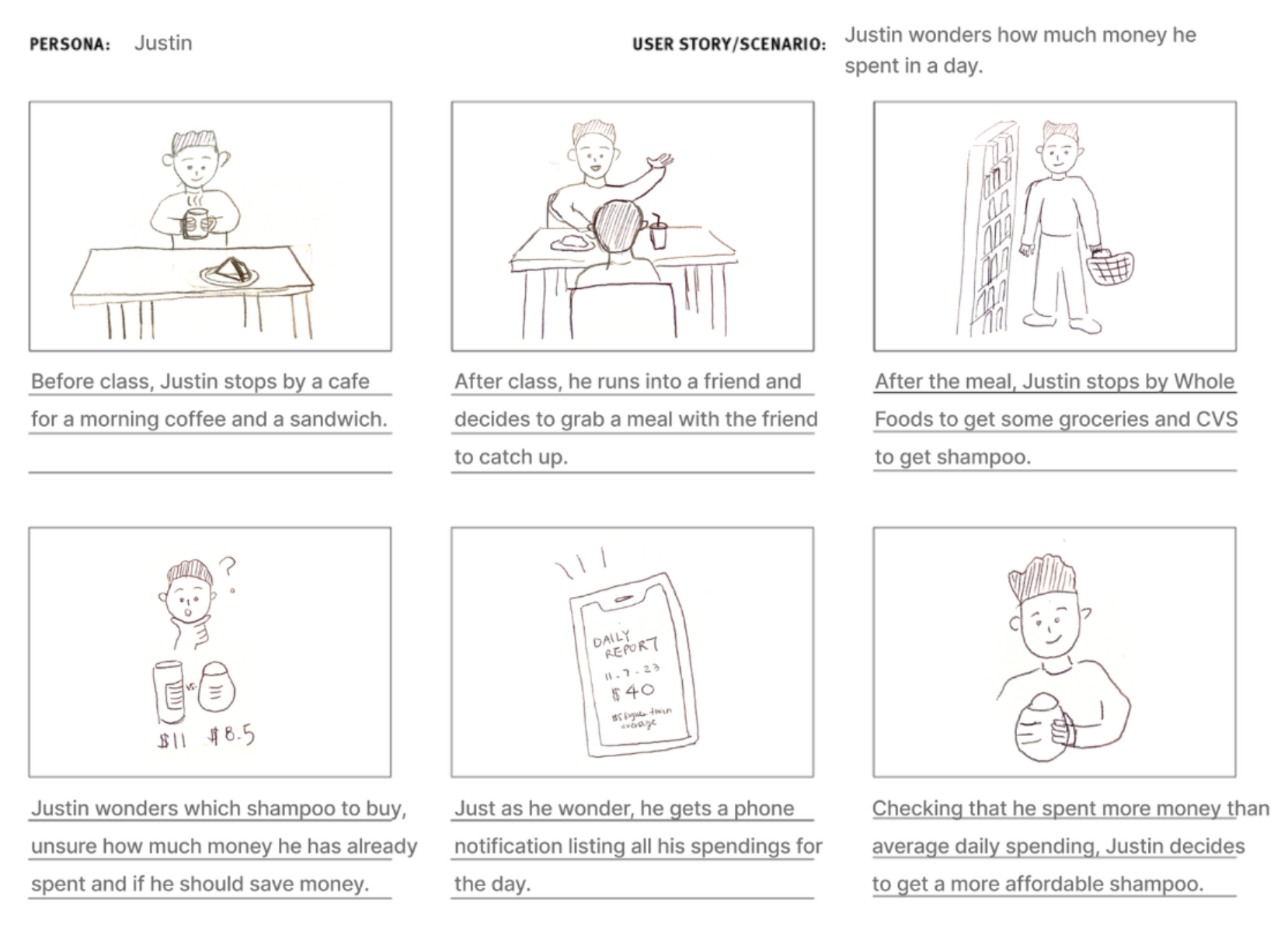

Persona + Story Board

Make | What can you offer your users?

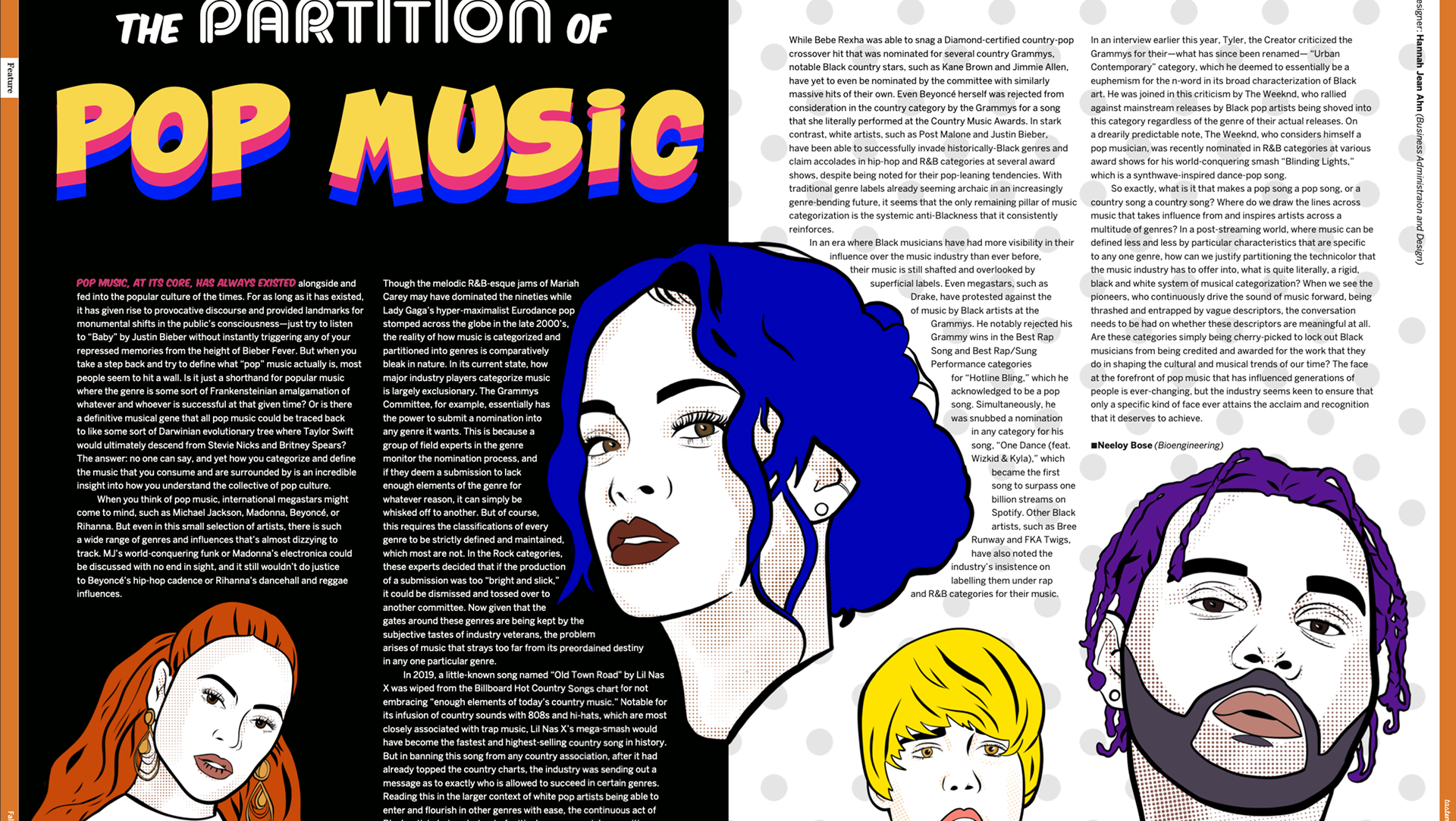

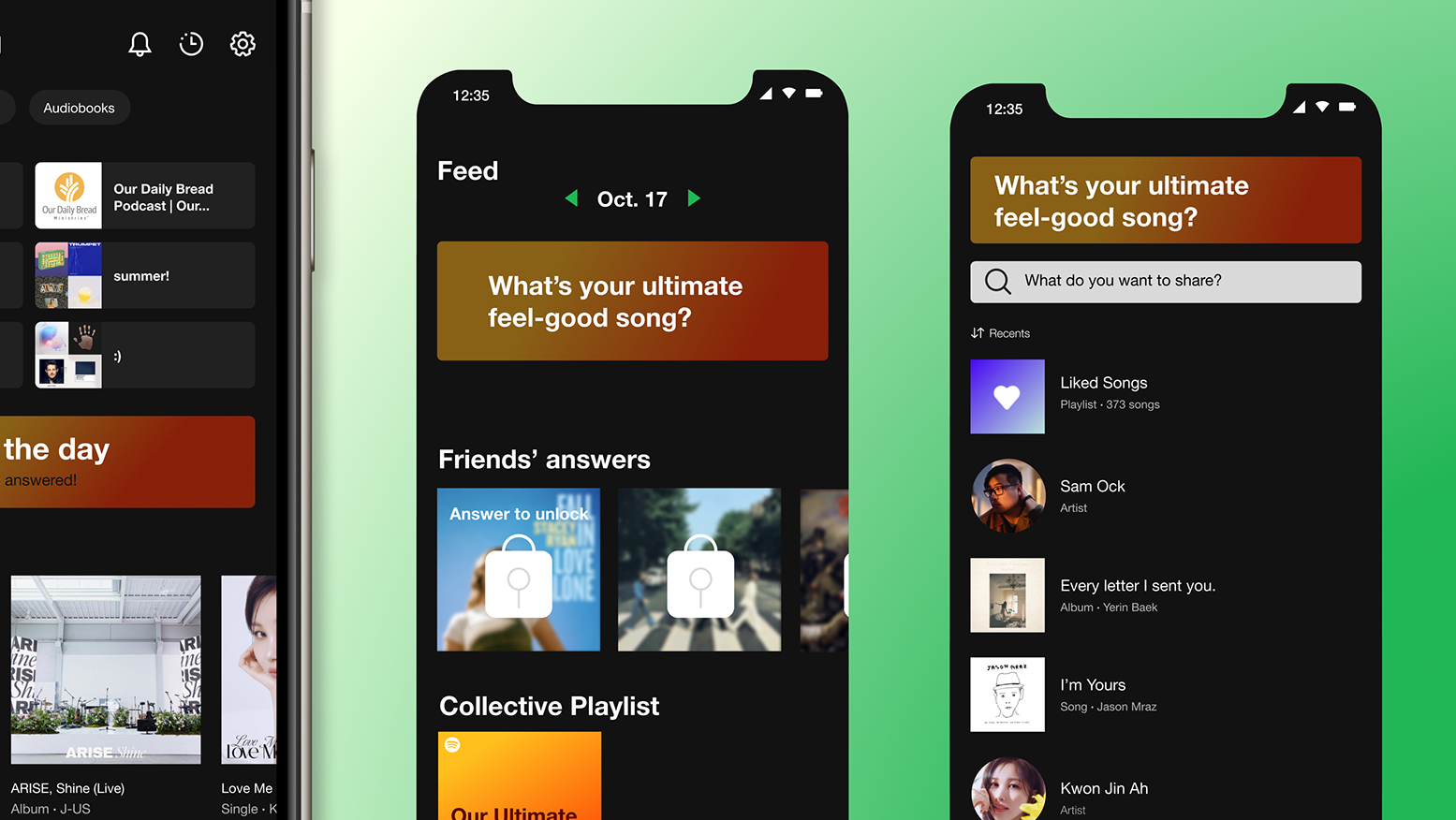

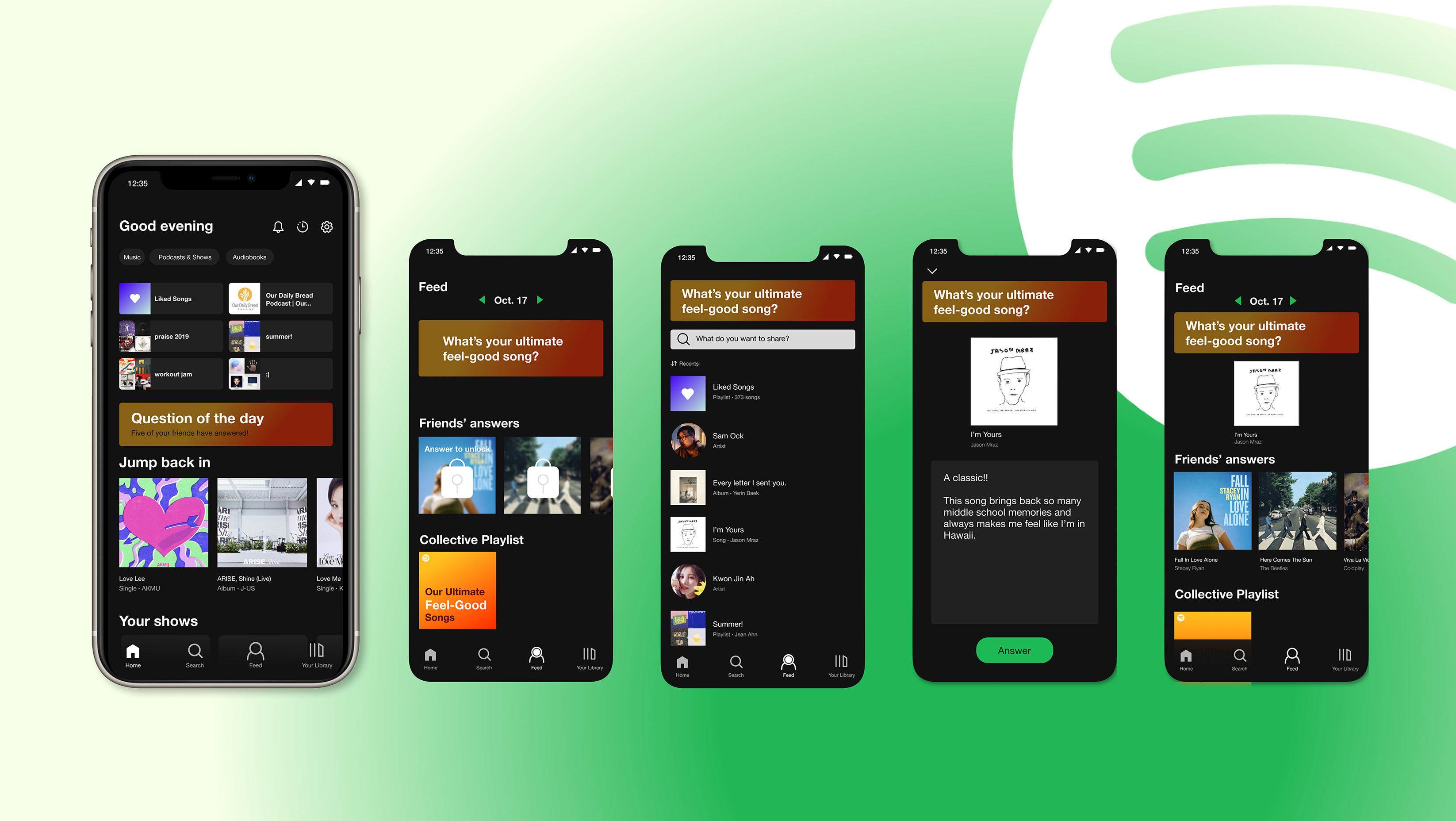

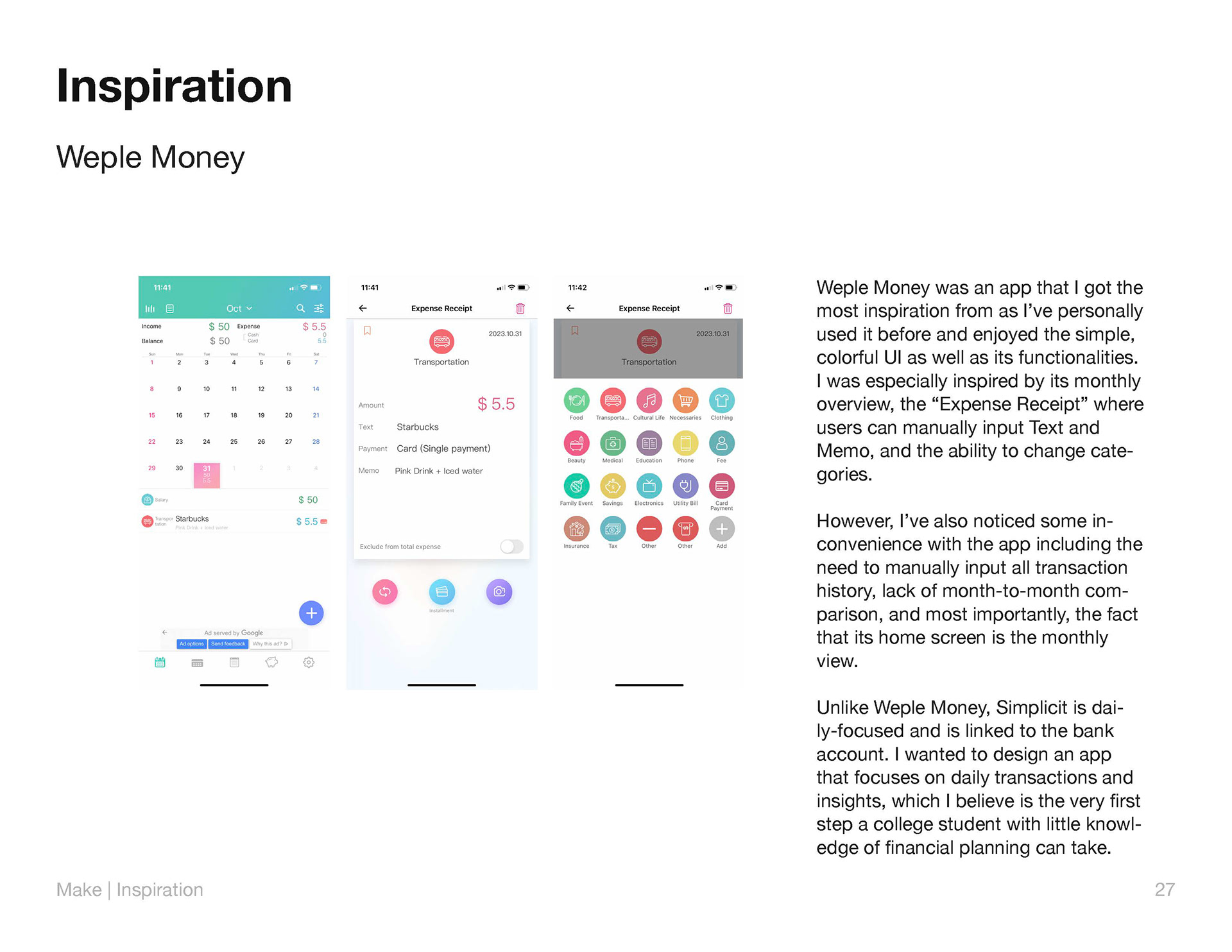

Inspiration

Paper Wireframes + Testing

Lo-fi Wireframes + Testing

Critique | How can you make it better?

Lo-fi to Hi-fi Improvements

Final Design IBM Plex Sans, IBM Plex Mono

Elevator Pitch

For personal finance beginners who want to track spending and save money without feeling overwhelmed, Simplicit is a finance app that automatically links to your bank account and provides daily “receipt” (snapshot) of your spending with its categories, allows users to set monthly goals, and rewards them.

For personal finance beginners who want to track spending and save money without feeling overwhelmed, Simplicit is a finance app that automatically links to your bank account and provides daily “receipt” (snapshot) of your spending with its categories, allows users to set monthly goals, and rewards them.

Unlike other tracking/budgeting apps like Weple Money and Mint, Simplicit is easy to navigate and engaging.

Onboarding

Onboarding includes...

• Short description of the app

• Connecting to bank account

• Setting time for notification

• Adding friends

• Short description of the app

• Connecting to bank account

• Setting time for notification

• Adding friends

"Receipt" Tab

Weekly View of the "Receipt"

There are two view modes under the "Receipt" tab— Weekly and Monthly. Weekly view allows users to see the total amount spent each day, a list of all transactions (amount and categories), insight of the day, and category breakdowns.

There are two view modes under the "Receipt" tab— Weekly and Monthly. Weekly view allows users to see the total amount spent each day, a list of all transactions (amount and categories), insight of the day, and category breakdowns.

Changing Categories and Adding Descriptions

In case Simplicit categorizes transactions wrongly, users can manually change the category. They can also add descriptions under each category (specific items purchased, any notes) that would be reflected on the home "Receipt" page.

In case Simplicit categorizes transactions wrongly, users can manually change the category. They can also add descriptions under each category (specific items purchased, any notes) that would be reflected on the home "Receipt" page.

Category Breakdown

Under Category Breakdown, users can check how much they've spend on each category.

Under Category Breakdown, users can check how much they've spend on each category.

Monthly View of the "Receipt"

Monthly view shows how much was spent each day, a Monthly Summary with category breakdowns and Monthly Comparisons that shows which category had increased/decreased/same spending compared to the previous month.

Monthly view shows how much was spent each day, a Monthly Summary with category breakdowns and Monthly Comparisons that shows which category had increased/decreased/same spending compared to the previous month.

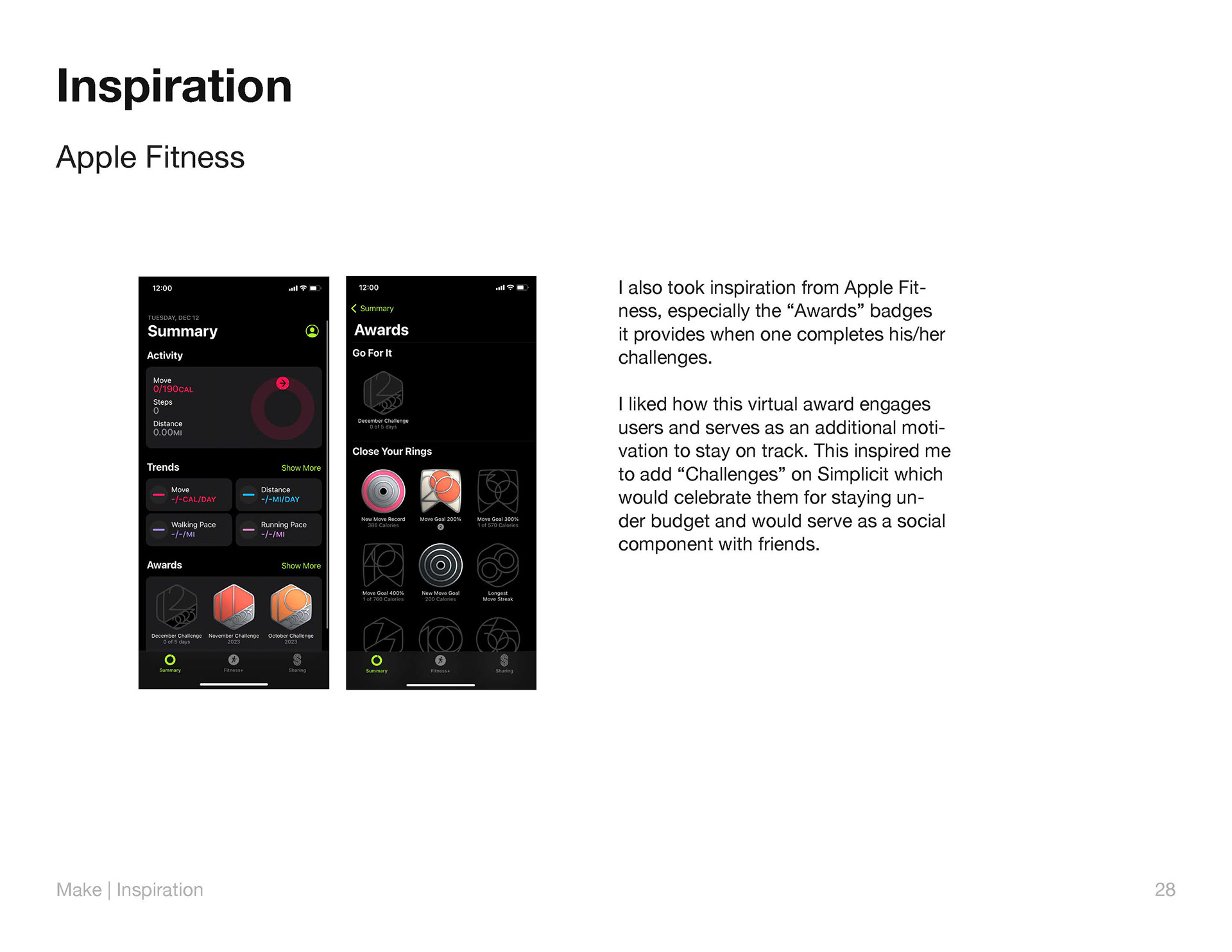

"Challenge" Tab

Challenge allows users to set monthly as well as categorical budgets. Users can receive badges if they spend under the budget amount. It also adds a social and competitive aspect as they can add friends to see if they spent less than they have planned.

Challenge allows users to set monthly as well as categorical budgets. Users can receive badges if they spend under the budget amount. It also adds a social and competitive aspect as they can add friends to see if they spent less than they have planned.

Style Guide